28+ Principal payment calculator

Be sure to label the additional payment apply to principal Simply rounding up each payment can go a long way in paying off your mortgage. Usually 15 or 30 years in the US.

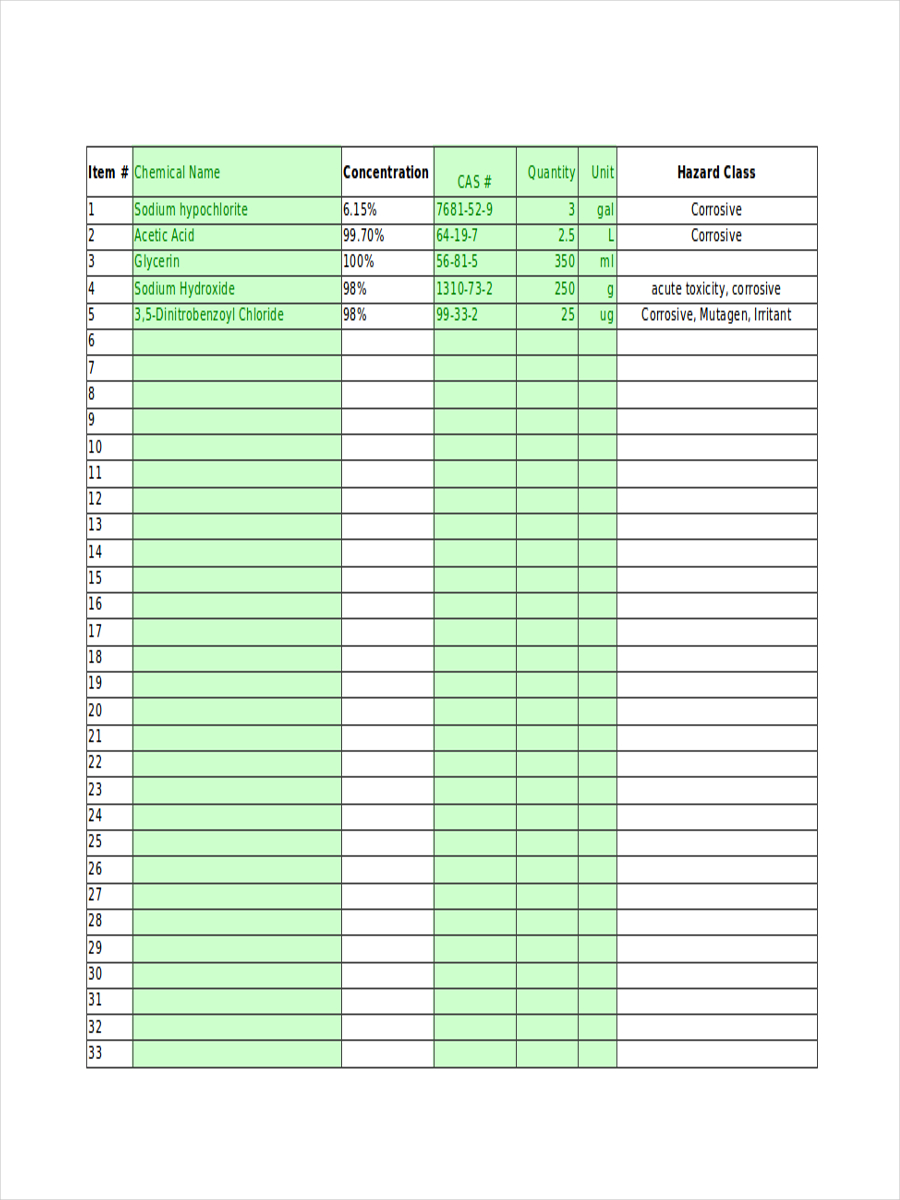

Inventory In Excel 28 Examples Format Sample Examples

Bi-Weekly Mortgage Payment Calculator Terms Definitions.

. We accept payment from your credit or debit cards. This is also calculated using the. How to change careers in 3 steps March 12 2021.

Prompt Payment Interest Calculator. Extra Principal Payment Help. They both need a front-end DTI ratio of 28 percent and a back-end DTI ratio of 43.

Use this PITI calculator to calculate your estimated mortgage payment. For a biweekly payment a 30-year term is multiplied by 26 resulting in 780 payments. If you need help determining the end date or due date use the Prompt Payment Due Date and Interest Rate Calculator first.

1 to 7 business days. This calculator figures monthly mortgage payments based on the principal borrowed the length of the loan and the annual interest rate. 93028 Oct 2022 92790 Nov 2022 92552 Dec 2022 92313 Jan 2023 920.

A monthly payment is multiplied by 12 resulting in 360 payments. With a 20 down payment on a 30-year mortgage and a 4 interest rate you need a household income of 70000 yearly or more before tax. That is unlike a typical loan which has a level periodic payment amount the principal portion of the payment is the same payment to payment and the interest portion of the payment is less each period due to the declining principal balance.

Total monthly mortgage payment. Monthly Taxes Insurance and PMI payment. Total Prepaid Principal - this is the total of any extra payments.

Full purchase cost including down payment etc. Total principal interest. Jan-3-2023 Payment 5 95483 66281 29203.

See the payment schedule for total interest saved. Almost any data field on this form may be calculated. 1681276 for surprisingly efficient and user-friendly and free comparison of refinancing rates on both home and.

A common strategy is to divide your monthly payment by 12 and make a separate principal-only payment at the end of every month. As skipping a mortgage payment only skips the interest and principal payment. 30-Year Fixed Mortgage Principal Loan Amount.

On the other hand if you want to reduce your principal faster you can go for an accelerated biweekly payment schedule. Many financial advisors believe that you should not spend more than 28. This calculator will help you to determine the principal and interest breakdown on any given payment number.

A portion of the monthly payment is called the principal which is the original amount borrowed. Enter the loans original terms principal interest rate number of payments and monthly payment amount and well show how much of your current payment is applied to principal and interest. We also accept payment through.

Payment 28 95483 63958 31525 Total 2024. N the total number of payments. Enter the appropriate numbers in each slot leaving blank or zero the value that you wish to determine and then click Calculate to update the page.

Total monthly mortgage payments are typically made up of four components. Brets mortgageloan amortization schedule calculator. The accelerated payment calculator will calculate the effect of making extra principal payments.

Note the total interest saved is reported on the. Interest The percentage rate charged for borrowing money. Monthly Principal and Interest Payment.

R - the monthly interest rateSince the quoted yearly percentage rate is not a compounded rate the. Lets say 400 goes towards principal and 800 to interest on day 30 your principal goes down 400 but if you are paid bi-weekly and pay 600 at day 14 200 principal and 400 interest and 600 on day 28 you will make an extra payment in the year and the 200 decrease on day 14 decreases the balance for interest on day 28. And may receive a commission referral fee or payment from a provider when you click on a link to a product.

When you take out a mortgage you agree to pay the principal and interest over the life of the loan. Bi-Weekly Payments Payments that occur once every two weeks. Extra Payment Mortgage Calculator.

Loan Payment Calculator. Each month a payment is made from buyer to lender. Follow the tried-and-true 2836 percent rule.

Free mortgage calculator to find monthly payment total home ownership cost and amortization schedule with options for taxes PMI HOA and early payoff. PITI is an acronym that stands for principal interest taxes and insuranceAfter inputting the cost of your annual property. How much income you need depends on your down payment loan terms taxes and insurance.

We used the calculator on top the determine the results. PayPal is one of the most widely used money transfer method in the world. Use the interest rates calculator to forecast repayments.

Then the mortgage payment calculator will include the cost of CMHC insurance premiums into your mortgage by adding it to your principal balance. Principal interest taxes and. The general rule is that you can afford a mortgage that is 2x to 25x your gross income.

It is acceptable in most countries and thus making it the most effective payment method. For example if we include down payment on that 70000 annual salary your home budget shrinks to 275000 with a down payment of 10 percent if youre aiming to keep the 28 percent rule intact. For example instead of 763 pay 800.

Flexible terms does not require collateral. This calculator returns the dollar amount of interest on a late payment based on due date or end date later of servicegoods received or invoice date. Mortgage Loan The charging of real property by a debtor to a creditor as security for a debt.

Total Interest - assuming the debtor makes the payments as scheduled this is the interest they will pay over the term of the loan. The fixed monthly payment for a fixed rate mortgage is the amount paid by the borrower every month that ensures that the loan is paid off in full with interest at the end of its term. Loan calculator showing lump sum payment made.

The total monthly mortgage payment. The first one makes extra payments at the start of the term while the second one starts making extra payments by the sixth year. A minimal extra principal payment made along with a regular payment can save the borrower a large amount of interest over the life of a loan particularly if those payments start when the debt is relatively new.

A fixed principal payment loan has a declining payment amount. An MMM-Recommended Bonus as of August 2021. The principal loan amount.

Principal Amount The total amount borrowed from the lender. Calculate loan payment. The monthly payment formula is based on the annuity formulaThe monthly payment c depends upon.

Thus the payment amount declines from. Use our free Principal and Interest Calculator to see your mortgage principal vs interest split. The calculator lets you find out how your monthly.

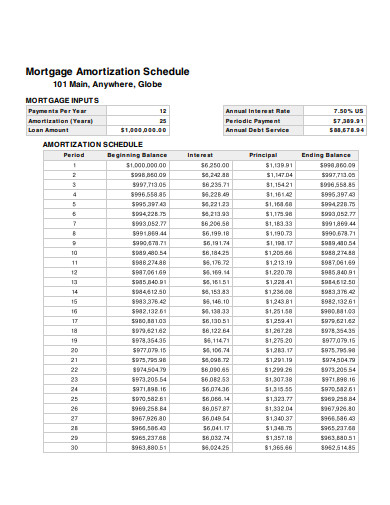

Tables To Calculate Loan Amortization Schedule Free Business Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

Payslip Templates 28 Free Printable Excel Word Formats Templates Excel Words

Our Indexes Clustered And Non Clustered Firebolt

Payslip Templates 28 Free Printable Excel Word Formats Business Template Templates Professional Templates

Payslip Templates 28 Free Printable Excel Word Formats Excel Templates Excel Templates

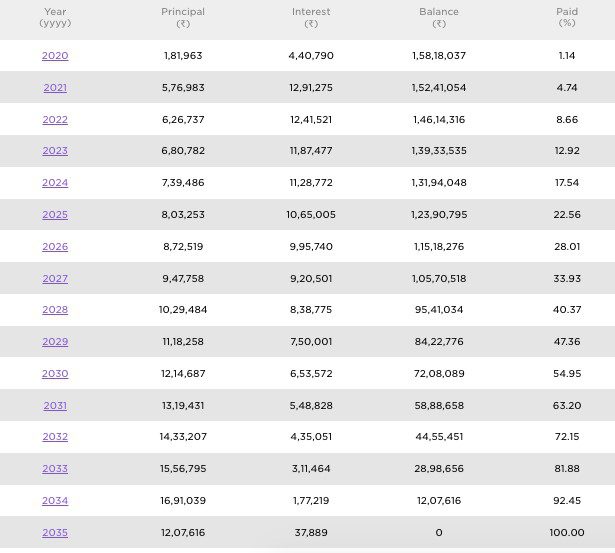

Sbi Home Loan Calculator 2019 Store 60 Off Www Oldtrianglecharlottetown Com

Tables To Calculate Loan Amortization Schedule Free Business Templates

11 Mortgage Amortization Schedule Templates In Pdf Doc Free Premium Templates

Our Indexes Clustered And Non Clustered Firebolt

Sbi Home Loan Calculator 2019 Store 60 Off Www Oldtrianglecharlottetown Com

Tables To Calculate Loan Amortization Schedule Free Business Templates

Payslip Templates 28 Free Printable Excel Word Formats Templates Cover Letter Format Excel

2

2

Sbi Home Loan Calculator 2019 Store 60 Off Www Oldtrianglecharlottetown Com

Purchase Requisition Form Templates 10 Free Xlsx Doc Pdf Formats College Application Essay Templates Excel Templates